Too much money is a problem

In the startup world, founders often ask and compare how much money each other raised. In accelerators like Techstars or YCombinator, fundraising numbers quickly become a dick-measuring contest: the more a founder raises, the more attractive their startup is, and the more others perceive this startup as the next big thing.

There is nothing more wrong than this.

The goal of a startup is to:

build a great product that delights customers

let the world knows about it

ultimately, make money

To reach these goals, you need to have (1) a strong team and (2) work relentlessly until you achieve your goals. Nothing else matters.

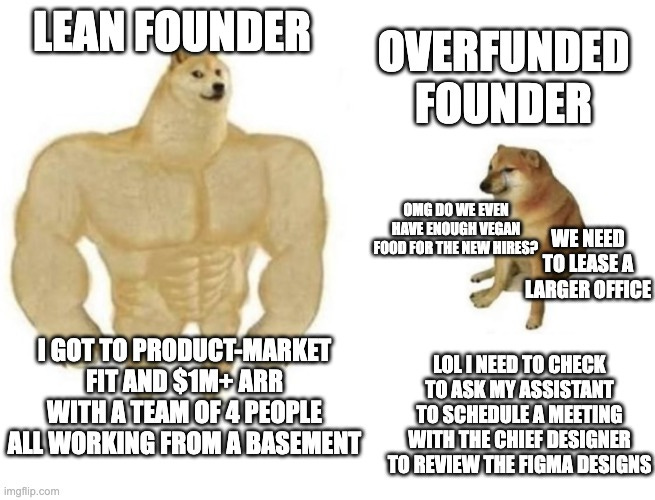

Too much money distracts you.

More money is very likely to distract you from reaching these goals. With too much money, you are tempted to spend it on something, even if it does not make sense or is a nice-to-have that will barely change the needle on anything. More marketing, more designers, more promotional events: pick the hole where your dollars will be lost.

One great example of a startup that failed with too much money is Fast: they raised more than $120M from prominent investors like Stripe and were burning $10M every month to get, on average, $50k of revenue (and yes, these are monthly numbers). Fast did not fail because of not enough money but probably of a lack of vision, an inability to execute, and too many distractions (there are countless stories online about this startup, like this article or this Twitter thread). They had so much money that instead of building a great product with a lean team, the CEO was outside driving a Nascar car. Burning $10M per month so quickly requires a lot of effort. It drives you away from the business fundamentals (build a great product).

Less money brings scarcity and focus.

Running with a small amount of money has two benefits: (1)focus and (2)ownership.

With less money, you are sharp and focused on building a great product. You do not waste any resources on things that do not matter. It forces you to stay lean to avoid the temptation to divert from your plan.

When you raise less money, you give less ownership away to investors and keep control of the company. It’s crucial, especially in the early stages: you want to have a few investors that trust your vision and avoid interruptions from investors asking you too many questions and preventing you from focusing on building a great product.

Tope Awotona did not raise money to build calendly: he invested his 401k (approximately $200k) for building the product, which is way less than what startups raised for a seed round today. In the Calendly episode of “How I Build This”, Awotona explains how tight money was and how it forced him to build the product and sell it early. He had no choice but to quickly build and sell. The result is clear: today, calendly has $100M ARR.

Now, should you avoid raising money? No

You should raise enough to reach your goals and have a margin of error. Give away some shares of your company to accelerate its growth. But do not raise too much money that distracts you from the fundamentals and gives up too much control of your company.